Home

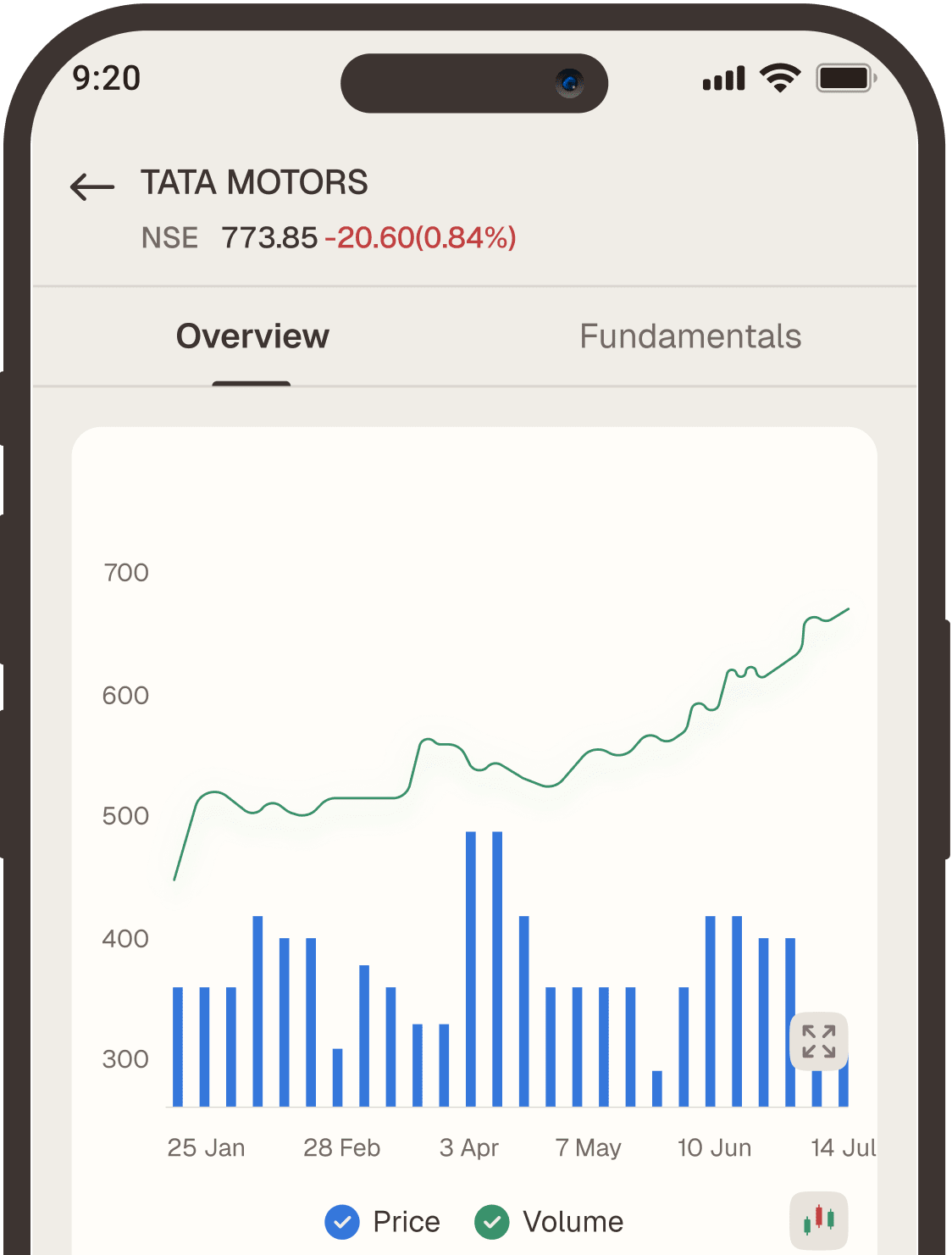

Stocks

Explore Listed Stocks in India and Start Investing with CapMint

Search Stocks. Analyze. Invest.

Tailor-made features

Pro Trading

Equip yourself with powerful tools and expert strategies to trade with confidence.

Master the Market

Learn the fundamentals, terms, and key concepts to navigate markets with confidence.

Learn with Courses

Explore courses to grow your skills step-by-step, from basics to pro strategies.

Links:

Download Centre

Investor Charters & Grievance Reports

Most Important Terms and Conditions

Advisory to Investors

Account Opening

Filing a Complaint

SMART ODR

IRRA

NCL Client Collateral

Privacy Policy

Terms and Conditions

Disclosures

Policies

FAQs

Corporate Governance

Risk Disclosure on Derivatives

RMS Policy

Mintcap Brokers Private Limited

CIN – U66110KA2023PTC178706 | Registered Address: Plot No 1290, Second Floor, 17th Cross, 5th Main, Sector-7, HSR Layout, Bangalore 560102 | Tel: 080 – 49552310 | Email ID: compliance@capmint.com | SEBI registered Stock Broker: INZ000322732 | NSE Cash/F&O Member ID: 90430 | BSE Cash/F&O Member ID: 6903 | MCX Member ID: 57400 | NCDEX Member ID: 1312 | SEBI registered Depository Participant: IN-DP-806-2025 | CDSL DP ID: 12102300 | AMFI-Registered Mutual Fund Distributor: ARN-289109 (Valid upto 28-Feb-2027) | Category II Execution Only Platform : E6903

Details of Client Bank Account

Compliance Officer: Ms. Shridevi Vungarala | Email ID: compliance@capmint.com | Tel no. + 91 9035330126 | Grievance Redressal Officer (GRO) – Ms. Shikha Gupta | Email ID: Grievance@capmint.com | Tel no: 9035331595.

Procedure to file a complaint on SEBI SCORES: Register on SCORES portal. Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID. Benefits: Effective Communication, Speedy redressal of the grievances. You may refer the website https://scores.sebi.gov.in/ for more information. You may also download the SEBI Scores app to log a complaint Android: https://play.google.com > store > apps > sebiscores iOS: https://apps.apple.com > app > sebiscores

Disclaimer

Investment in the securities market are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed the SEBI prescribed limit.

Mutual fund investments are subject to market risks, read all scheme related documents carefully before investing. Mutual Funds are not exchange-traded products.

Attention Investor:

- Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

- Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

- Pay 20% as upfront margin of the transaction value to trade in cash market segment.

- Investors may please refer to the Exchange’s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard.

- Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.